This blog post continues our CECL blog series, where we hope to answer your CECL questions one blog at a time.

Welcome back to the CLA CECL Blog Series. As a reminder, over the next several weeks, CLA will take a deep dive into many of the hot topics surrounding the Current Expected Credit Loss (CECL) standard. In this blog, we’ll discuss the basics of qualitative factors and forecasting. Don’t forget – on October 28, 2021, CLA will host a webinar designed to answer any remaining questions you may have. Make sure you receive our invitations by signing up for CLA communications here. We hope you find great value in this blog series and welcome the interaction with any of the authors.

Guidance

One of the significant aspects of the Allowance for Credit Losses (ACL) standard will be quantifying the qualitative adjustments to be applied to your lifetime loss calculation. As ASC 326-20-30-7 states, “An entity shall consider relevant qualitative and quantitative factors that relate to the environment in which the entity operates and are specific to the borrower(s).” This will require management teams to identify both internal and external information which may impact the ACL calculation. Management teams should evaluate data elements that could result in changes in expected future credits losses when compared to the historical lifetime loss calculation.

Qualitative Factors

Staff Accounting Bulletin (SAB) 119 issued by the Securities and Exchange Commission (SEC) and the Comptroller’s Handbook – Allowance for Credit Losses Version 1.0, April 2021 issued by the Office of the Comptroller of the Currency (OCC) both provide guidance relating to factors that should be considered when adjusting historical lifetime loss information. These items include, but are not limited to:

- Nature and volume of the institution’s financial assets

- Existence, growth, and effect of any concentrations of credit

- Volume and severity of past due financial assets, the volume of nonaccrual assets, and the volume and severity of adversely classified or graded assets

- Value of the underlying collateral for loans that are not collateral-dependent

- Institution’s lending policies and procedures, including changes in underwriting standards, collections, write-offs, and recoveries

- Quality of the institution’s credit review function

- Experience, ability, and depth of the institution’s lending, investment, collection, and other relevant management and staff

- Effect of other external factors such as the regulatory, legal, and technological environments; competition; and events such as natural disasters

- Actual and expected changes in international, national, regional, and local economic and business conditions and developments in which the bank operates that affect collectibility of financial assets.

- Effects of any changes in reasonable and supportable economic forecasts

One should note these factors are similar to those already being evaluated under the current allowance for loan loss methodology. The main difference is management teams should be applying a forward-looking lens when evaluating these criteria. For example, if management is evaluating the underlying collateral value element, and in the current year management changed the required loan to value (LTV) requirement on commercial real estate loans from 70% to 80%, the inherent risk of loss was increased from historical levels as a higher LTV is now accepted. Thus, management will likely want to add to the ACL to compensate for this risk. Conversely, if underwriting standards are tighten compared to the historical information being included in the calculation, management may need to apply negative factors to reduce the expectation of loss.

Forecasting

In addition to qualitative assessments, management teams are also required to incorporate reasonable and supportable forecasts into their ACL calculation. As noted in ASC 326-20-30-9, “An entity shall not rely solely on past events to estimate expected credit losses. When an entity uses historical loss information, it shall consider the need to adjust historical information to reflect the extent to which management expects current conditions and reasonable and supportable forecasts to differ from the conditions that existed for the period over which historical information was evaluated.” Therefore, management teams will need to identify data elements that may produce different results than the historical data. This will require forecasting these elements, and its effect on charge-offs, over a reasonable and supportable forecast period, and then reverting back to historical data at the conclusion of the reasonable and supportable forecast period. Per the standard, “An entity may revert to historical loss information immediately, on a straight-line basis, or using another rational and systematic basis.”

For example, management may determine that the unemployment rate is a strong indicator of charge-off activity. Management would need to forecast what it believes unemployment rates will be over a reasonable and supportable forecast period. For example, management may believe, based on industry data, that it can reasonably forecast the unemployment rate for the next two years. Management would then evaluate its expectation of the unemployment rate and the impact on its expected charge-offs over that two-year period, i.e. if they expect unemployment to increase, they will add to the ACL. After the two-year forecast period is concluded, reversion to historical loss rates is appropriate for the remaining life of the loans.

Available Tools

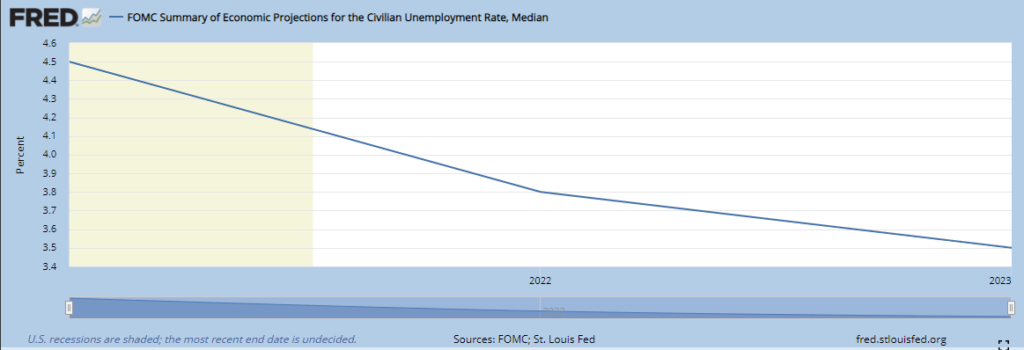

Management teams will need to evaluate tools and data available to determine the appropriate means by which to evaluate these elements. One tool that may prove useful is the Federal Reserve Bank’s (FRB) FRED Graph tool. This tool can be found at https://fred.stlouisfed.org/graph/?g=4VT and provides access to many economic data points. In addition, it provides the forecasts of certain data elements from the U.S. Federal Open Markets Committee (FOMC), such as unemployment rate as shown below:

Management teams can start with this tool to identify data elements that may assist in determining whether the inherent risk of credit loss in the institution’s loan portfolio is increasing or decreasing. From there, management teams can start to quantify these adjustments to the ACL.

Conclusion

Applying qualitative factor and forecasting adjustments to historical lifetime loss rates is a critical piece of an institution’s ACL calculation, especially for those with limited loss history. In utilizing the tools available, such as the FRED Graph tool, management teams can begin identifying data elements that affect the inherent risk of charge-offs being incurred. This will then allow institutions to appropriately adjust their ACL for forecasted changes in the loan portfolio and economy.

How can we help?

Regardless of where your institution is at on your CECL journey, CLA is prepared to assist your institution in any way we can. Throughout this blog series or at any time, contact us with your questions. We look forward to being a resource for your institution as you navigate the implementation process!

Contact us

Want to learn more? Complete the form below and we'll be in touch. If you are unable to see the form below, please complete your submission here.