As we look to a future post-elections, it’s time to review your investment and tax strategies. We discuss approaches for year-end and for 2021.

Key insights

- As political uncertainty begins to recede after the U.S. elections, let’s address key investment and tax considerations heading into both year-end and 2021.

- On the investments front, markets at their highs combined with expensive valuations drive the importance of realizing capital gains or harvesting tax losses.

- On the tax front, consider whether to harvest income and capital gains before year-end, ahead of any potential tax increases in 2021.

- Amid potential uncertainty about what may lie ahead, it is critical to have a well-diversified investment strategy along with a thoughtful tax plan to navigate any choppy waters.

Looking to seamlessly integrate your investment and tax strategies?

Year-end is typically a time of reflection and deliberation. This year, this planning process will take on heightened importance for business owners and individuals alike.

Potential changes may be ahead. As the Biden presidency appears more certain, media attention is turning to the party composition of the U.S. Congress as well as the potential future impact of COVID-19 on our economy and society. However, amid this unpredictability, we see several investment and tax decisions individuals could proactively consider before the end of the calendar year.

Factors to review going into year-end 2020

Consider taking profits off the table, given rich valuations and favorable capital gains rates

From an investment perspective, markets are expensive. While some investors cheered at the Dow Jones or the S&P 500 stock market benchmarks rallying almost 8% to reach new highs, we should also analyze whether these prices have kept up with the earnings of companies included in these indices.

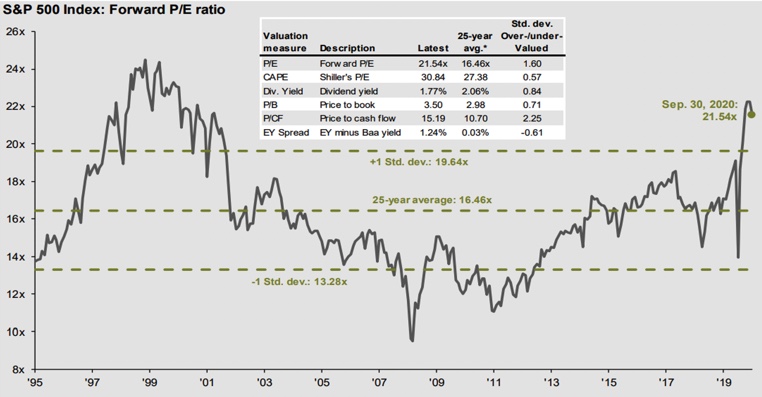

As seen by the chart below, this has not been the case. The fundamental relationship between price and earnings — known as the P/E ratio — is currently at 21.54, a hefty 31% above the long-term average of 16.46, indicating that the broad stock market is expensive. Digging deeper, technology stocks have rallied even more than broad benchmarks, sporting a +32% return.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

While we advocate holding core U.S. equity exposure, and especially believe in the long-term growth in technology-related companies, investors may want to consider taking some money off the table at these heightened valuation levels.

In addition to harvesting investment gains that may have come from an expensive market, capital gains tax rates are very favorable right now. As indicated in the chart below, Biden’s proposed tax plan includes income and capital gains rate increases. With a potential for tax increases, consider whether 2020 is a year to try to accelerate income and recognize capital gains to retain more post-tax profits.

| Biden’s proposed tax plan | ||

|---|---|---|

| Current rate | Biden proposal | |

| Top ordinary income tax rate | 37% | 39.6% |

| Top capital gains rate* | 20% | 39.6% |

| Estate tax** | 40% | 45% |

| Corporate income tax | 21% | 28% |

**Lower $3.5 million estate tax exemption for individuals, $7 million for married couples, also proposed.

Source: Bloomberg Tax

Determine whether new investment and tax planning strategies may make sense

One mechanism to potentially accelerate income and take advantage of reduced income tax rates is to convert a traditional IRA to a Roth IRA. We've highlighted this strategy in a recent article. As IRA conversions have numerous tax and investment implications, discuss this strategy with your advisor before implementing it.

For taxpayers who’ve accumulated substantial wealth, it may be the right time to consider whether to utilize some of your estate tax lifetime exemption to move assets out of your estate. Be on the lookout for an article about estate tax strategies in a new post-election update next week.

Review opportunities to reduce taxable income

Taxpayers weary of triggering large tax bills by accelerating income can look to capture some opportunities to reduce income. For individuals looking to accomplish some philanthropic goals, 2020 is a year that offers some distinct charitable opportunities.

Under the CARES Act, individuals can deduct charitable contributions up to 100% of their adjusted gross income (AGI) for contributions made by December 31, 2020. Contributions must be made to qualifying charitable organizations and only cash contributions can be utilized for this expanded threshold. Stock or property contributions do not qualify for the 100% of AGI deduction limit, nor do donations to donor-advised funds.

Opportunity Zone investments can be an effective strategy to defer current capital gains and reduce the amount of future capital gains to be recognized. Our recent article outlines some of the benefits of utilizing Opportunity Zone investments. Consult your advisor to determine if this strategy may be an option.

Considerations for 2021 and beyond

An integrated investment and tax plan can help you identify opportunities

For 2021 and beyond, as you review your investment portfolios, remember that asset markets will continue to be supported by significant stimulus from policy makers. The Federal Reserve is currently implementing a $700 billion asset purchase program to support markets in the post-COVID era, in addition to cutting interest rates to zero.

Additionally, during an early-November Federal Reserve Board meeting, Chairman Jerome Powell specifically urged renewed fiscal support. He noted that “further [economic] support is likely to be needed to avoid further spread of the virus and help individuals who, with the expiration of the CARES Act payments, are seeing their savings dwindle."

When reviewing your investment strategies into 2021, follow the simple time-tested approach of diversification. Specifically, build an investment portfolio that fits your risk profile by taking advantage of a broad range of public and private market opportunities.

If you’re looking at meeting income needs in a zero-interest rate world, consider discussing with your financial advisor corporate credit markets, equity dividends, and private real estate exposure. Additionally, there may be select areas of growth with investments such as Qualified Opportunity Zones, as noted above.

From a tax perspective, review these seven year-end tax planning strategies. CLA’s tax professionals can help you with these and any other applicable tax strategies.

How we can help

At CLA, we take our role as your professional advisor very seriously. We believe investors should maintain a resilient investment portfolio approach and practical tax plan. While uncertainty may remain high, you can take actionable steps today to navigate uncertainty in the months and years ahead.

Contact Us