Key insights

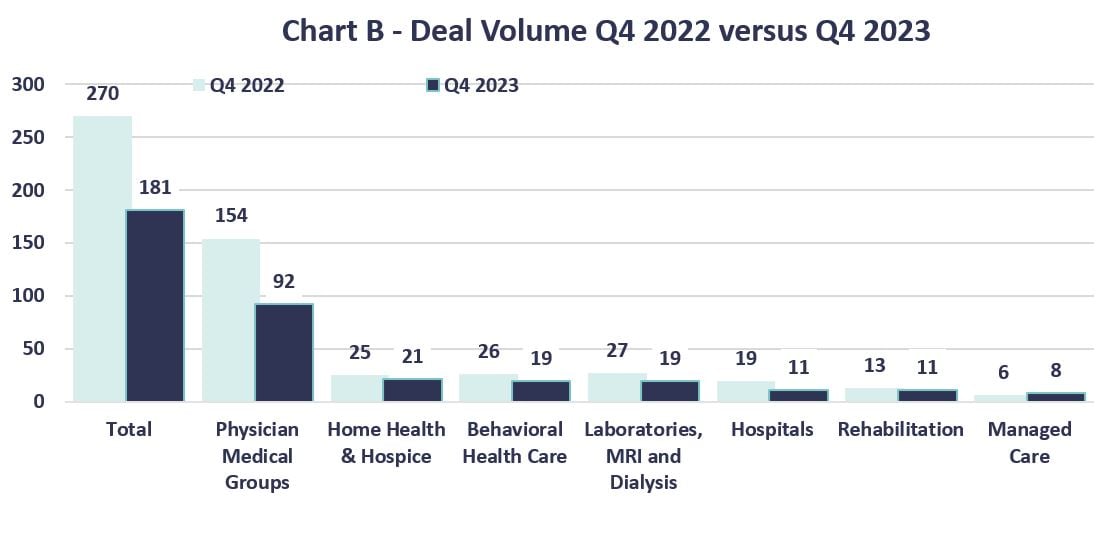

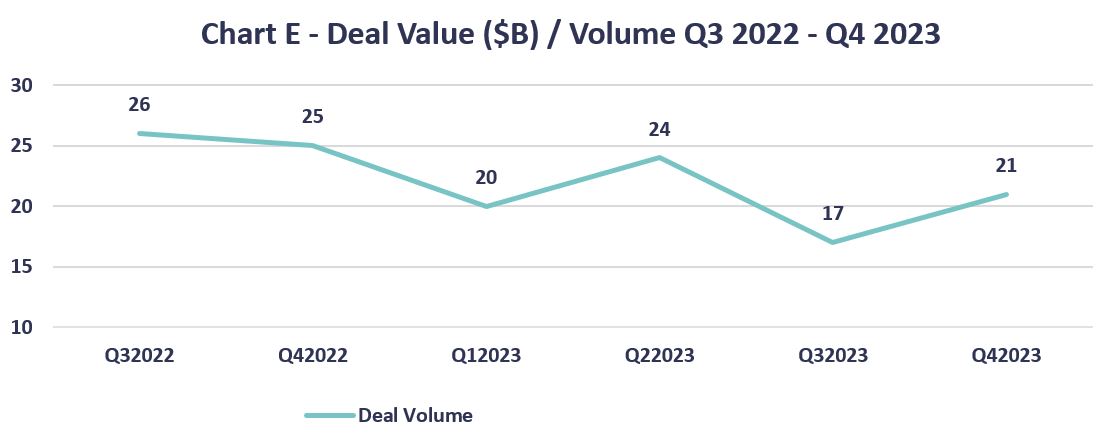

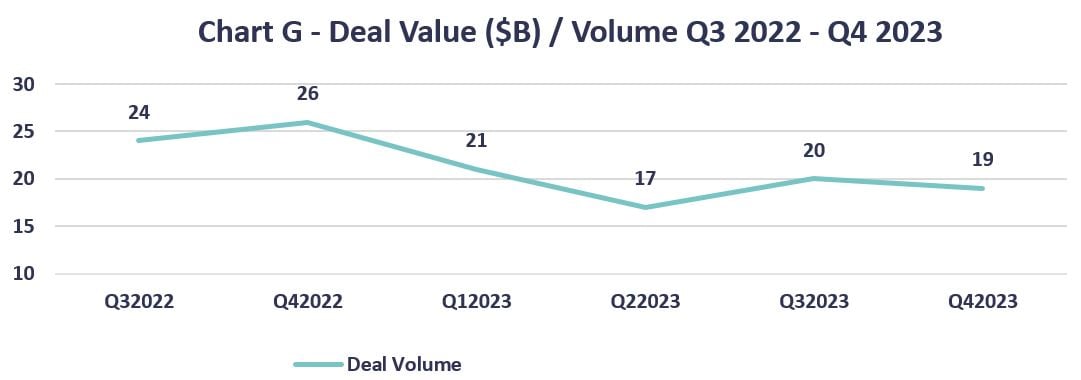

- Nearly all sectors of health care services saw decreased deal volumes throughout 2023.

- Access to labor, cost inflation, and a higher interest rate environment led to decreased activity.

- 2024 is expected to be an active year due to stabilizing macro-economic factors and levels on capital raised to deploy.

Use health care deal-making data in your transaction decisions.

As we move through 2024, we anticipate seeing continued investment in innovative health care segments as the economy and markets stabilize. Examining the data of deal-making can help you make more informed decisions on potential transactions.

The health care services market is still attractive

The market fell last year from its post-pandemic high of deal making due to the economic environment and uncertainty. Rising interest rates and significant inflation caused compressed margins and more scrutiny in the deal-making process. As a result, transactions took longer to close, with more scrutiny in earnings before interest, taxes, depreciation, and amortization (EBITDA) underwriting and pro forma considerations. There also was a widening gap between seller and buyer valuation expectations.

Regulatory concerns continue to make headlines, particularly with the Biden administration’s scrutiny of private equity investment in health care and its potential impact on patient services and health care consolidation.

While 2023 saw a decline in deal volumes, the health care services market remains attractive and has many opportunities in a variety of fragmented segments.

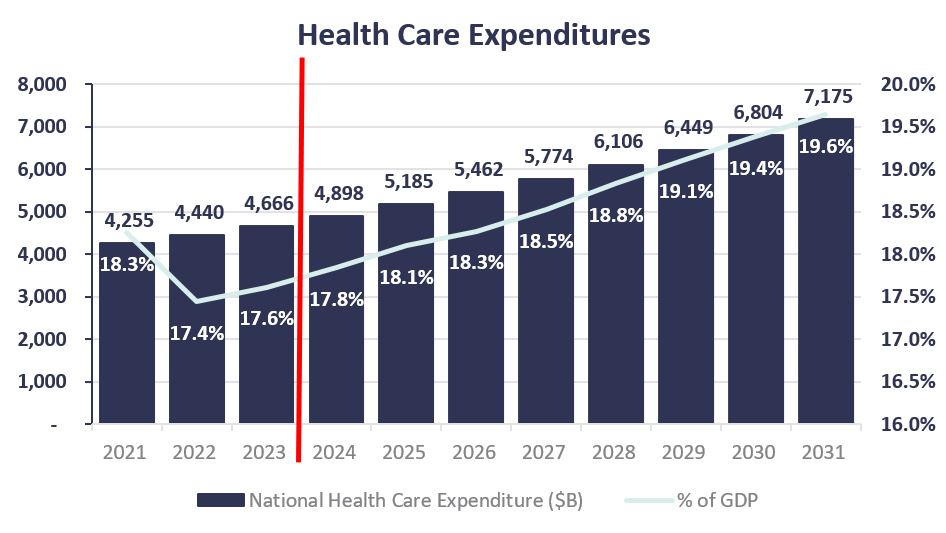

As shown in the chart below, national health care expenditure represents approximately 17% of the gross domestic product (GDP) and is expected to increase to nearly 20%. By 2031, this will represent a 67% increase in GDP. This concentration of health care spend creates an attractive opportunity for investors.

Transaction trends are poised to rise

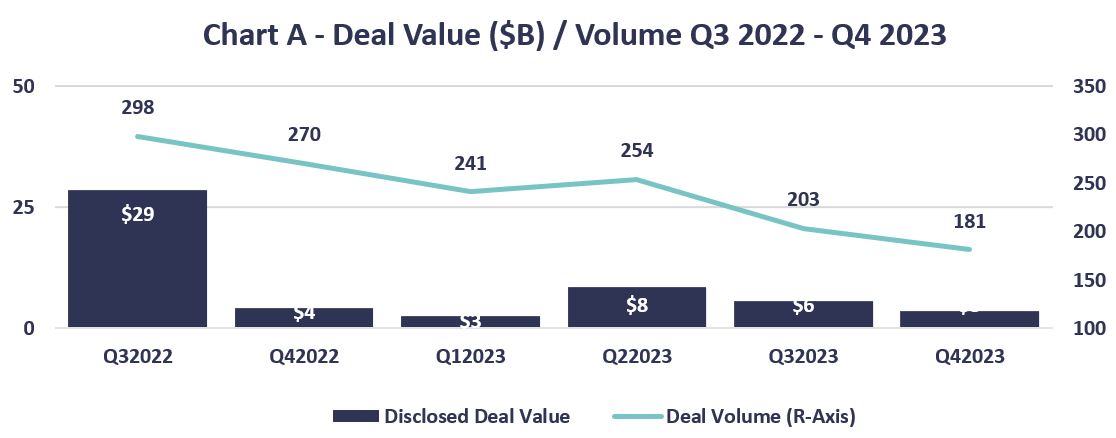

Chart A reflects the quarterly transaction volumes of selected health care services segments, with nearly 100 fewer announced transactions in the fourth quarter of 2023 versus 2022. Chart A comprises health care providers including physician medical groups, home health and hospice providers, behavioral health care providers, labs, rehabilitation, hospitals, and managed care.

The years preceding 2023 were record years for the healthcare merger and acquisition (M&A) market. Given economic uncertainty during 2023, it’s no surprise transaction counts trended downward. Although 2023 activity is lower than 2022, there was still interesting transaction activity.

With inflation beginning to subside and no shortage of investor capital to put to work, 2024 will likely be a more active year.

*represents those where purchase price has been disclosed

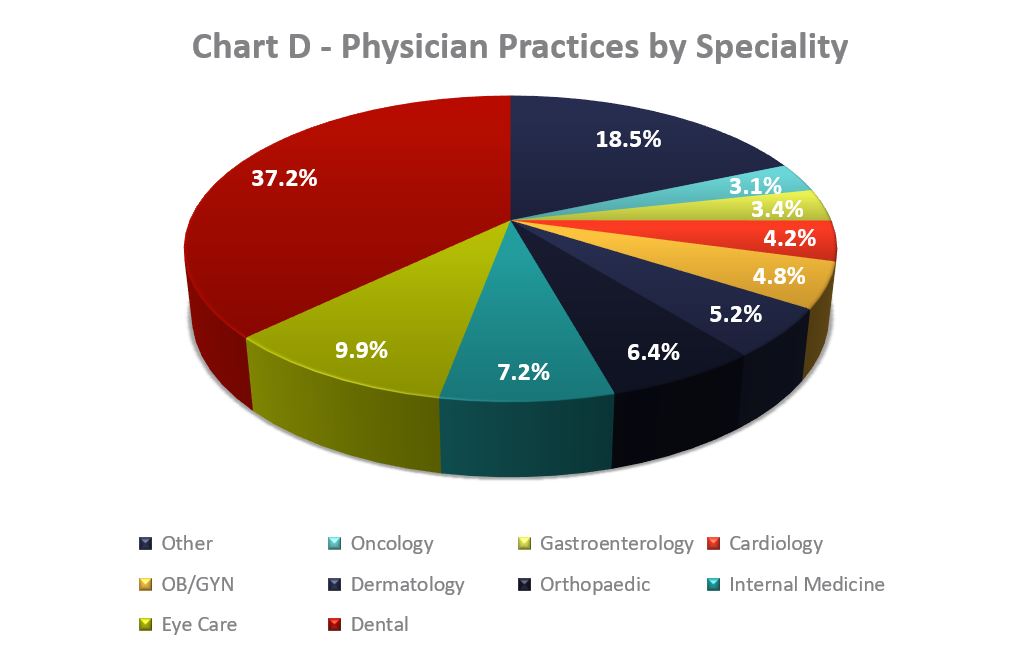

As shown in Chart B, physician practices are still a highly sought after segment, likely due to their fragmented nature and numerous specialties that attract investments.

As shown in Chart C, private equity continues to be a driving force in consolidating health care services. This is expected to continue due to the levels of capital raised.

M&A activity among health care segments

Physician practice management

Physician practices across specialties have been sought after for years. Many physician-owned practices are weighing the costs and benefits of remaining independent while dealing with the financial pressures of declining reimbursement, rising costs, and regulatory burdens. The health care landscape is also changing rapidly with value-based payment models, artificial intelligence impacts, and increased competition from larger organizations and health systems.

Physician retirement and the desires of new physicians entering the market are also considerations. Using a management service organization can come with far less administrative burden, along with access to important technologies and the potential for attractive future investment returns. Similar sentiments are applicable to the dental industry and dental service organizations.

- Dental and eye care practices have been highly sought-after acquisition targets for several years, with high deal volumes generally driven off a series of small practice acquisitions.

- Private equity is a primary driver of deal activity, representing most physician practice management transactions announced.

- The GDP for physician services is projected to grow at the same rate as the national health care expenditures shown previously. Physician services represent approximately 20% of the overall national health care spending, making it a significant portion of the health care costs incurred.

Home health and hospice

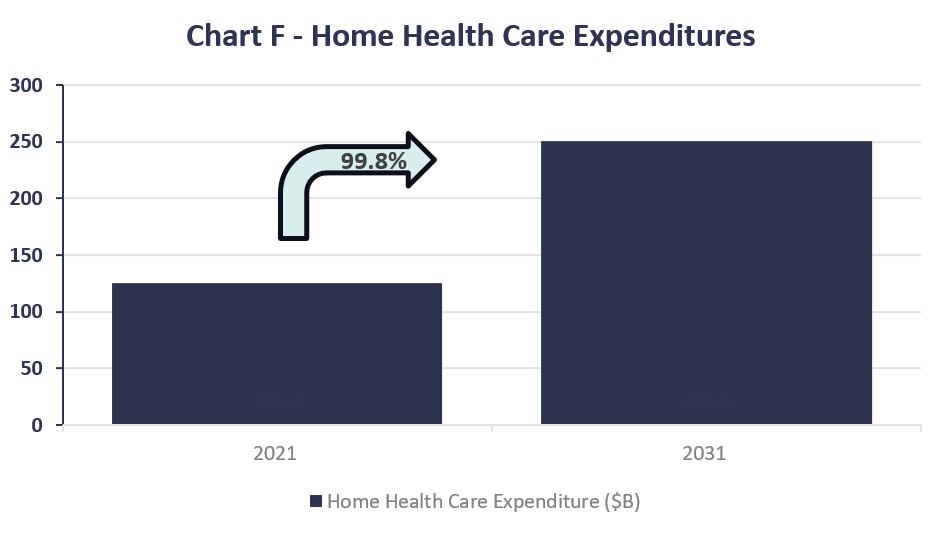

Coming out of the COVID-19 pandemic, home health and hospice transactions rebounded quickly, then experienced the decline seen across health care services.

The pandemic accelerated the emergent shift toward home care and community-based alternatives. Providers showed their ability to care for higher-need populations in the home versus traditional settings and had the opportunity to pose alternative care and payment models. However, uncertainty around Medicare payment combined with economic uncertainty slowed deal activity.

Consistent with the overall increase in national health care costs, home health care costs are projected to increase approximately 8% per year. Current projections from the Centers for Medicare & Medicaid Services show an approximate 100% increase in home health costs from the 10-year period from 2021 to 2031 versus the previously noted 67% increase in overall national health care spend. The expected need and use of home health care will increase at a higher rate, and private equity continues to drive this M&A market.

Behavioral health services

Behavioral health has been edging into the spotlight in recent years and was further emphasized by the COVID-19 pandemic. Behavioral health consists of:

- Substance use (counseling, rehabilitation, medication-assisted treatment)

- Autism (autism treatment services)

- Intellectual and developmental disabilities (assistance with cognitive function and behavior)

- Eating disorders (eating behavior counseling)

- Counseling (health counseling / therapy)

- Inpatient behavioral (physical psychiatric hospital)

While substance use disorder and autism services have historically been attractive investment areas, mental health services now appear to the most sought-after behavioral health transaction.

Like other provider types, market fragmentation and projected consumer demand are key drivers of the consolidation with private equity continuing to propel much of the deal making.

How we can help

As we move through 2024, we anticipate seeing continued investment in health care segments. Not only is CLA watching these deals, we are also watching other market moves and regulatory scrutiny.

CLA goes beyond traditional accounting and financial analysis, and scrutinizes key assumptions underlying the deal — drawing on the deep health care experience of our dedicated health care transaction services team.

Contact Us

Use health care deal-making data in your transaction decisions. Complete the form below to connect with CLA.

If you are unable to see the form below, please complete your submission here.